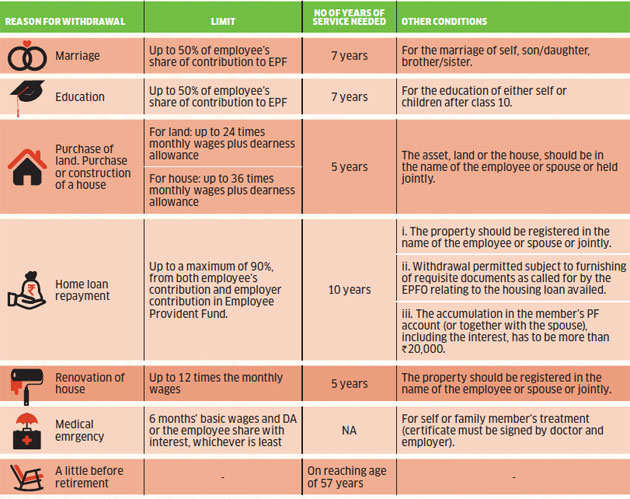

Minimum of 10 years EPF membership is required to withdraw the PF amount for the home loan payment. However before retiring too you can take money out of your EPF account for a variety of reasons.

One Year Before Retirement Epf Withdrawal 12 Instances When You Can Apply For Non Refundable Epf Advance The Economic Times

EPF Withdrawal for Home Loan.

. Ad Get Your Free Quote Today. Under Section 68 BB of Employee Provident Fund and Miscellaneous Provision Act 1952 employees can get 36 months basic wage DA or total of employee and employer share with interest whichever is least. Our Eligibility Checker Tool Will Show you Loan Deals Without Harming Your Credit Score.

Ad Fill In Our Form Find Out How Much Equity You Could Release From Your Home. Compare the Cheapest Homeowner Loans in the UK Compared by Our Trusted Experts Apply Now. The withdrawal is done through the From 31 form for EPF partial withdrawal.

Get An Estimate To See How Much Cash You Could Unlock From The Equity In Your Home. Partial Withdrawal Full Withdrawal Home Member Withdrawals Last updated. However EPFO allows its members to withdraw a certain amount as an advance more so known as EPF loan in case of certain financial requirements such as illness wedding purchase of a property renovation of home education etc.

And this withdrawal is only possible if one is in the service for 5 years. Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request. Applicant can withdraw housing loan for ONE house only.

This is the potential monetary gain should the EPF withdrawal is not made and the RM 60k remains reinvested in EPF. FV of PV60000 for N30 i504 minus PV Future Value for RM 60k over the period of 30 years with annual compounding of 504 minus original principal of RM 60k. EPFO Housing Loan Apply online.

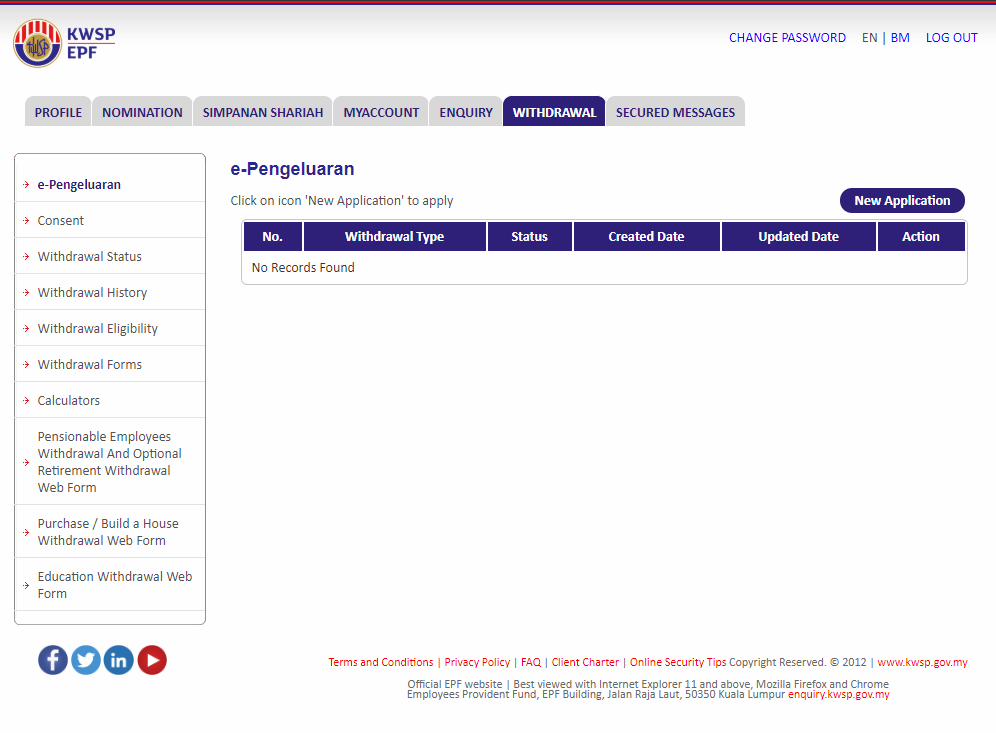

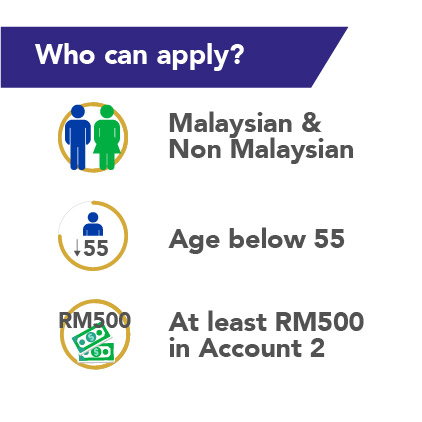

Employee Provident Fund can be used to renovate homes or during the buying process. If the withdrawal is to purchase for second house the first house must be sold or the disposal of ownership of the first property has taken place. When you reach the age of 55 you can start withdrawing money from your EPF account.

An employee can prepay the home loan by withdrawing the PF amount. Ad Soft Search Shows your Chance of Approval without Harming Your Credit Score. Withdrawing from your EPF The terms of the Employees Provident Fund EPF scheme allow you to withdraw money from your account for a variety of reasons.

Withdrawals To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Consider the EPF interest rate and home loans rates. The certificate of outstanding home loan.

For the withdrawal the employee should have reached at least 10 years of service. One can partially withdraw the amount if heshe has applied for a loan for purchasing or renovating house. Ad Get Your Free Quote Today.

The employees provident fund organization EPFO has laid down rules for insured members to withdraw either in advance or full settlement the. The legal formalities and paper work will cost 10 of the total cost of property to be settled. It enables employees to withdraw up to 90 of their total contributed EPF retirement money for real estate investments.

Compare the Cheapest Homeowner Loans in the UK Compared by Our Trusted Experts Apply Now. The Employee Provident Fund Organisation EPFO has launched an EPF housing loan scheme. Borrow 10k-500k at the Lowest Rates in the UK.

The maximum PF withdrawal limit is up to 90 percent of the PF. The legal formalities include registration stamp paper payment and more. An individual who has a Provident Fund PF account is allowed to withdraw funds from it against a loan.

For the last financial year 2020-21 is more than the home loan rate as of October 2021 most banks are giving home loans at 66-70 pa you should not make an EPF withdrawal. Below are the guidelines to withdraw account 2 of EPF savings to finance the purchase of a house. The withdrawal amount sanctioned for this reason.

36 times of monthly salary or Total contribution or. If the EPF rate 85 pa. People who want to buy house quickly.

An employee can withdraw PF for a home loan only after a minimum of three years of service. Borrow 10k-500k at the Lowest Rates in the UK. Instead you should go for a home loan as it can help you get additional income tax.

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Loan Store 52 Off Www Ingeniovirtual Com

Kwsp Housing Loan Monthly Installment

How To Withdraw Pf Online And Offline

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Epf Loan Online 50 Off Www Ingeniovirtual Com

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

Speedy Epf Withdrawals The Star

Epf Loan Online 50 Off Www Ingeniovirtual Com

How To Avail Online Epf Withdrawal Facility Mymoneysage Blog

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

Kwsp Housing Loan Monthly Installment

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

Online Epf Claim Facility Procedure Process Flow Conditions